Why "SHOOTING STAR" got failed?

Trading is not all about patterns/technical or fundamental analysis.

Why?

Most of the times it will be easy or maybe sometimes it will be complicated

Anyhow, if you really want to be a great trader or investor, you need an observation.

Again saying that you don't want to have the highest IQ or more of intelligence, all you need is simple logic or common sense.

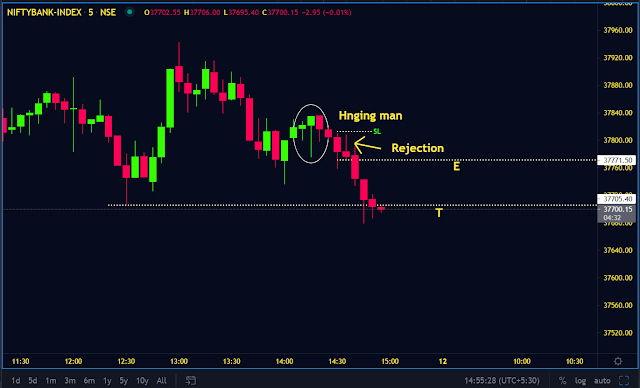

Coming to the point if you start observing the above chart, its clear cut selling from higher levels.

Technical evidence is there as a shooting star plus followup selling pressure was exist.

But the stock did not go down as the bookish concepts.

Now if we start to observe the candlesticks, we may come to know what's happening to the particular stock

I have marked the zone(downside wick potion), this is now a very crucial and interesting part to understanding the battle between bulls and bears.

Exactly sellers are trying to sell, they are doing their job, but buyers are very strong and they are defending the sellers in a hard way.

How to know buyers are trying to defend them?

If you start observing the zone, within the zone price is halting for many days, and unable to move beyond this small demand or accumulation zone.

The exact level 1154.65 acting as strong support, there is no doubt for many days.

Then what about lower wicks, their wicks represents overwhelming response from the sellers, but again sellers are failed to close the price below the zone (lower wick)

So when sellers are entering into the markets, buyers are strongly defending the price. They are holding the price and they are waiting for enough buyers to push the prices to the upside.

Look at the 6th green candle after the shooting star candle, buyers tried to control the markets, the immediate next day sellers entered into the markets, now we need more focus. What is dramatically changing from bulls to bears?

Nothing has changed dramatically, there is small doji candle formation, this represents the seller's weakness (less force from the sellers)

If you observe the price action, and 8th candlestick after the shooting star, its gap down day and closed indecisively. After this doji formation, the next immediate day is an explosive move to the upside with a little gap up.

This move can give confidence to those who want to participate in the direction of the primary trend, at the same time it hurts whoever has short positions in the underlying asset.

We may have to go with our logic,

Logic is retailers or short term traders, who short the stock and are getting trapped.

This shooting star candlestick formation forced them to take short against the “STRONG TREND”

So always finding bottom and top is a risky job, that's the reason philosophical quote comes

“Trend is our friend”

*Shorting stocks and holding overnight is not possible, still you can short futures/options and can hold them for overnight.

#stock=underlying asset=markets