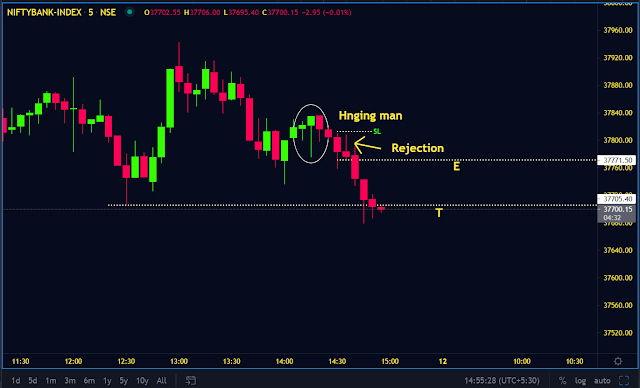

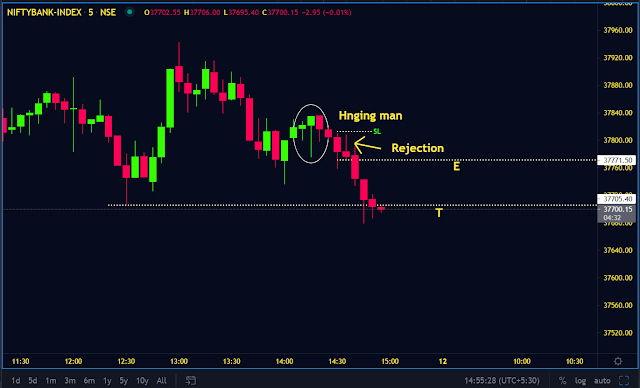

Trading is not all about patterns/technical or fundamental analysis. Why? Most of the times it will be easy or maybe sometimes it will be complicated Anyhow, if you really want to be a great trader or investor, you need an observation. Again saying that you don't want to have the highest IQ or more of intelligence, all you need is simple logic or common sense. Coming to the point if you start observing the above chart, its clear cut selling from higher levels. Technical evidence is there as a shooting star plus followup selling pressure was exist. But the stock did not go down as the bookish concepts. Now if we start to observe the candlesticks, we may come to know what's happening to the particular stock I have marked the zone(downside wick potion), this is now a very crucial and interesting part to understanding the battle between bulls and bears. Exactly sellers are trying to sell, they are doing their job, but buyers are very strong and they are defending the sellers in...