Popular posts from this blog

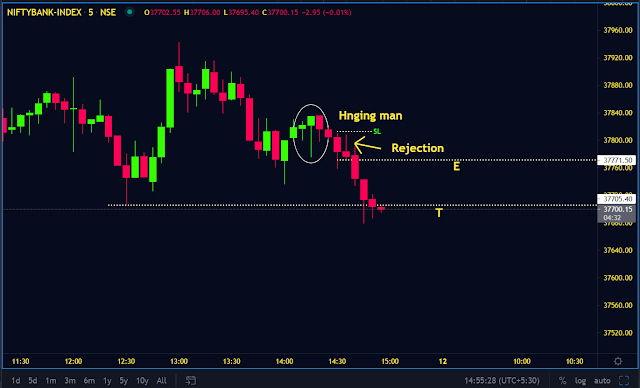

Where sellers are waiting?

How to know where the sellers zone? Once of the best areas or zones to watch, where price is struggling to move upside and take the “U” turn. This is generally referred to be supply/resistance/sellers zone. All we need is to draw the zone of the left side wick and extend the zone to the right side. Now the extended zone can be considered as a supply zone. When the stock approaches this level, chances are sellers to get activated. In the above fig, if the wick was created by sellers, now we need to draw the entire wick and extend the zone to the right side. Sellers are getting activated, whenever the stock approaches the supply zone. Now all need a simple observation from the candlestick. There are multiple bearish engulfing candlestick formations. It’s clearly saying that the sellers are very strong. Now we can sell below the bearish engulfing candle, now the stop loss needs to keep above the supply zone. *Keeping stop loss is tricky, as the market approaches this resistance zone...

Why "SHOOTING STAR" got failed?

Trading is not all about patterns/technical or fundamental analysis. Why? Most of the times it will be easy or maybe sometimes it will be complicated Anyhow, if you really want to be a great trader or investor, you need an observation. Again saying that you don't want to have the highest IQ or more of intelligence, all you need is simple logic or common sense. Coming to the point if you start observing the above chart, its clear cut selling from higher levels. Technical evidence is there as a shooting star plus followup selling pressure was exist. But the stock did not go down as the bookish concepts. Now if we start to observe the candlesticks, we may come to know what's happening to the particular stock I have marked the zone(downside wick potion), this is now a very crucial and interesting part to understanding the battle between bulls and bears. Exactly sellers are trying to sell, they are doing their job, but buyers are very strong and they are defending the sellers in...