The inner meaning of the "DOUBLE BOTTOM"

What is the inner meaning of the double bottom?

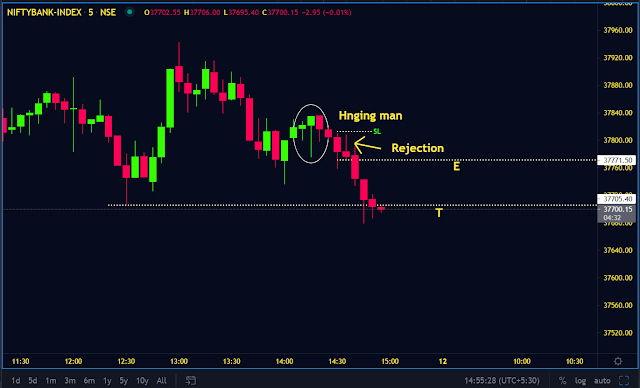

Whenever a stock comes to the support we look for buying opportunities.

Here I am trying to explain the concept behind the double bottom.

You have to be open-minded about the context, focus on the price instead of a pattern.

If you observe the price alone, the stock started falling from the level “R”, i.e. said to be resistant.

Now you need to find good support to buy. If you observe the price @ “1”, the stock is halting and taking a sort of up move called pullback.

But we won't consider it as strong support.

Why?

Whenever the stock or market is falling we need strong evidence, to trade against the primary trend.

Why should I not try to buy @ level “1”?

The reason is so simple, whenever sellers start selling from higher levels, after some correction they might recover the stocks at a cheaper price, that might be the reason to first-time bounce.

And the second reason is logic: when the first bounce is happening retailers will come to rescue the stock and they might think that the stock was available at a cheaper price and they might be a buyer, coming to the logic, now institutions know this fact. Then they will start selling stocks to shake out them or to hunt their mental/hard stops.

The same thing happened at level “2".In fact, there is no significant price difference between level “1” & “2”. But it's all about the stop loss hunting process.

So as a technical analyst or trader, we must be aware of all major traps.

Now coming to buying the stock at level “2” is easy, because there is a strong bullish engulfing candle and good buyer interaction is happening.

But buying at level “2” is also a risky job, why?

We need to retest, once the market starts swinging to the upside, again chances to come back to retest or re-check their belief or sometimes this move can be used to shake out the small players or weak traders.

In this pullback or downside move, now we need to observe the force between buyer and sellers.

How could it be possible?

It's easy not rocket science, all we need to know about candlesticks and their behaviour.

If you start to observe the level “3”

The bottom candle is indecision: it means sellers are trying to give up gradually.

And observe the 3 consecutive candlesticks from the low, the bottom one is doji, and the second candle(above the doji) is sellers force, they are strong for sure, the third candle above the 2nd candle is doji. We have 2 dojis out of 3 candles. It's a sign of weakness from the seller's points of view.

Now it's clear buyers are entering into the markets, or trying to defend the sellers.

Now it's clear sellers are drying when the stock approaches the previous swing.

This doesn't mean buyers are in complete control again.

So all we can come up with the best decision is not to short the markets at level “3”.

Again we have multiple choices to trigger

2.We can wait for the confirmation from the buyers (we need to wait for a big green candle to appear) that gives us confirmation from buyers participation.

3.we can play option via strategies, like

a)Market can be flat

b)Market can be bullish...etc.

*At level “3” 4th candle from the bottom given the confirmation that strong buyers are entered into the markets, i.e. resultant strong green candle.

Thank you

Twitter: @sigma_daytrader